Car insurance premium factocrs.txt

For most motorists, the underlying reason for paying car insurance premiums becomes some sort of mystery. Why is it that your neighbor pays less than you even with a perfect driving record and you keep on paying skyrocketing premiums? In truth, however, how much you will pay for coverage translates to no mystery; in reality, rather, there are a multitude of factors which come into play when determining how much you will ultimately end up paying for car insurance. And thus familiarity with those factors can help you understand why you pay as much as you do and perhaps take some steps to reduce that amount. Let’s try then to delve into some of the main premium factors that determine your rates at car insurance.

- Driving History

Driving record is probably among the things that may form the basis for your car insurance over at their rates. Insurers scrutinize your record to know the amount of risk you pose.

Accidents: You are bound to pay high premiums if you have car accidents especially when you are at fault. The tiniest accident means that your premium increases.

Traffic Offenses: The more speeding offenses and DUI convictions together with other traffic offenses, the more the number of offenses makes you a horrible driver. Thus, driving becomes very costly because of expensive insurance charges.

Claims: You may have more claims, however small they may be. This can make your insurance very expensive to charge.

- Age and Experience

Typically, it is the relatively young driver with fewer years of experience who pays more expensive car insurance. That is because such drivers are statistically likely to cause accidents.

Teen Drivers: Among all these categories, normally, the premium for teen drivers is steepest because the teen driver has hardly spent any time behind the wheel .

Older Drivers: Once you pass your early years of approximately 20 years, premiums may drop; however during your old age, the rate may increase again due to age as one of the legitimate reasons such as slowing reaction time.

- Gender

Most states take into consideration the gender when making decisions on insurance premiums especially concerning the teenager category.

Male vs. Female: Studies have indicated that female young drivers are considered less risky in executing behaviors associated with risks, which differentiate males from their female counterparts. As such, it makes insurance expensive for the young male population, and this gap often reverses as the age of the driver advances.

- Location

The place you will be staying greatly determines your premium insurance charges. Where one stays is weighed on its accident cases, crime rates, and even climatic conditions.

Urban Areas: This would make your premiums pretty hefty in the urban areas, as these are heavy traffic zones, chances of car theft and vandalism and constant accidents.

Rural Areas: People tend to pay relatively less in the rural location due to fewer cars on road with lesser chances of accidents.

Weather Risks: If you reside in a hurricane flood area or hailstorm, your premiums would be even more tremendous due to the risks of potential damage to your vehicle.

- Vehicle Type

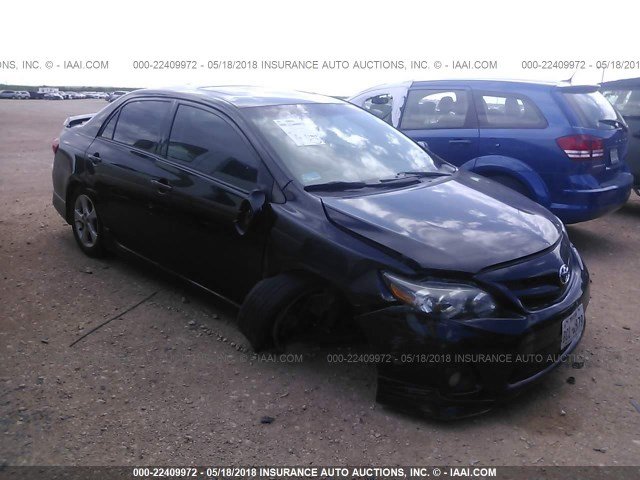

The particular car one drives has much to do with how much he will end up paying for insurance.

Make and Model: Commonly, the cost of insuring models of high-performance cars, luxury vehicles, and sports cars are expensive first because their replacement cost is highly expensive or their repair cost is significant and next addition for the reason that such vehicles have a high rate of accidents.

Safety Features: Those cars are also providing you with a discount if they carry such advance safety features as anti-lock brakes, airbags, and back-up cameras, which can potentially make injuries less likely

Age of Vehicle: Older cars cost less to insure because its value will be less, though if you want full or collision coverage, savings may not be spread to the fullest extent

- Coverage Level

The more you buy, the more likely it will be that you will pay a higher premium.

Liability: This is mandatory coverage under your state’s law. You will pay less for your premium if you have just minimum liability, but it also holds less coverage.7. Credit Score

It further decides the amount of car insurance in some states, and an individual’s credit score determines even that. Insurers think that those with a poor credit score have a high possibility of filing claims and therefore pose a threat to them for sure and hence more favorable to charge higher premiums for them.

Good Credit: And if the credit score is good, you’ll be eligible for lower premiums.

Bad Credit: A bad credit score will give you an opposite reward, as it might make your insurance expensive even when your driving record is perfect.

- Annual Miles

The more you drive, the longer you are exposed to accidents. The miles you drive each year are taken into consideration by the insurers.

Low Mileage: If you do not drive a lot each year (less than 10,000) you may be quoted lower rates because you are less statistically likely to have an accident.

High Mileage: Commuters, business travelers and others have higher rates since they spend more time at risk.

- Marital Status

Believe it or not, married people often pay less for car insurance than the single driver.

Why It’s Important Married people have fewer at-fault accidents, so they’re a lower risk. Statistically speaking.Discounts because of Loyalty: Some insurance companies also offer discounts when one has been an old customer and there have been no claims.

- Occupation

Some jobs expose one to risks that are less associated with insurance companies and one gets discounts or low rates.

Low-Risk Jobs: Teachers, engineers, and even healthcare workers often pay less premium because, statistically speaking, they are involved in fewer accidents.

High-Risk Jobs: If you happen to one of those jobs that require much driving or dangerous places, like being a delivery driver or a salesperson, then you’re going to be paying more on your car insurance.

- Use of the Car

Whether you use your car for personal purpose or professional purpose, utilization varies and hence increases or decreases the premium.

Private Use: If you use the car only for running errands and going to work, your probable premiums are going to be low. Here are some suggestions:

Shop Around: Get quotes from various companies so that you will know how competitive is the market and

Bundle policies: Have several insurance needs; home, life, auto bundle them all with one company in order to lower your premium.

Rebuild your credit score : That way you would be in a position to take advantage of much more favorable rates.

Drive carefully: Avoid accidents and tickets in order not to increase premium.

High Deductible: If you want to cut your premium per month, then this is a good option; however, only if you do not mind paying the piper when the time arises.

Install Safety Features: If the car doesn’t have its safety features rated as state of the art; the installation sometimes rewards with discounts.

Conclusion: Familiarizing Oneself with Car Insurance Premium Determinants

Car insurance premium pricing is complex by a wide range of factors that comprise; their past driving records, the kind of car they own, their location, and to some extent, even their credit scores. Factors that cannot be controlled can be minimized to a point if known. Knowing them gives you an idea of what to expect and where you can cut some slack. You are sure, then, to get a great rate on your car insurance if you made informed decisions, such as safe driving, proper choice of a car, and coverage.